Last Updated October 5, 2024 by Davina Kelly

I’ve read many money mindset books but today I wanted to share my Rich Dad Poor Dad book review.

It was the first personal finance book I ever read and it completely shifted my perspective on money and wealth.

If you’re reading this, you’re probably curious about whether this book is worth your time. So let me walk you through my personal Rich Dad Poor Dad book review and explain how it can impact your finances.

This post may contain affiliate links, which means we will receive a commission if you purchase through our links, at no extra cost to you. Please read full disclosure for more information.

Rich Dad Poor Dad Book Review:

My overall impression of Rich Dad Poor Dad is positive. It’s an inspiring and eye-opening book that had a big impact on me. The lessons completely shifted my money mindset and pushed me to think bigger.

Even though I already had a good handle on my finances, Kiyosaki’s teachings helped me step out of my comfort zone and aim higher.

What sets this book apart is that it doesn’t just give you the typical advice on saving and investing, which is why it’s so popular. Instead, it provides insights into how the rich think about money compared to the poor and middle class.

So you may not get personal finance tips, but this book provides motivation and unique insights that will definitely get you thinking differently about your finances.

What Rich Dad Poor Dad is About

Rich Dad Poor Dad is a classic book written by Robert Kiyosaki. It’s the number one best-selling personal finance book of all time and I can see why.

The book begins with the story of Kiyosaki’s childhood, where he and his best friend Mike were determined to learn how to become rich.

Throughout his life, Kiyosaki observed the different mindsets of his rich dad (Mike’s father) and his poor dad (his biological father).

This gave him a unique perspective on how these two men approached money and success and set the stage for the lessons that follow.

Poor Dad

The poor dad is his biological father who was very academic. He had impeccable grades and a high-paying job and believed this was the route to success. So, naturally, he wanted the same for Robert.

Poor Dad wanted Robert to pursue formal education (i.e. a Master’s or PhD), get a good job and work until retirement. However, poor dad lived paycheck to paycheck.

Rich Dad

On the other hand, the rich dad (his best friend’s dad) came from a different background and had a completely different approach to money.

He didn’t think formal education was a requirement for success. He believed in learning financial literacy through experience, investing and making your money work for you.

Kiyoaki’s rich dad highlights a crucial point: He says it’s a shame that schools don’t teach us how to manage money. I couldn’t agree more. With 56% of Americans unable to cover a $1,000 emergency, the consequences of this knowledge gap are clear.

This lack of education leaves many people struggling to manage their finances which shows how important it is to learn these skills early on.

The core message of this book is simple but powerful: The rich don’t work for money, they make money work for them.

Many of us were raised to believe that a good education and a secure job were the keys to financial success but Rich Dad Poor Dad challenges this.

Kiyosaki encourages you to rethink your approach to money and emphasises the importance of financial education, investing and entrepreneurship.

If you prefer the audio version, you can check out the Rich Dad Poor Dad audiobook on Amazon here.

Key Takeaways from Rich Dad Poor Dad:

1. Financial Education is Key

Throughout the book, Kiyosaki stresses that financial education is the true key to financial independence. Traditional school teaches us to work for money, but it doesn’t teach us how to make money work for us. The rich invest in financial knowledge that helps them grow their wealth.

Like many, I had always believed that building a successful career was the ultimate goal. But after reading this book, I realised that continuously educating myself about money and investments was just as important, if not more so.

If you want to invest in your financial education you can start by reading this book. You can also listen to podcasts and watch YouTube videos.

2. There is a Big Difference Between Assets and Liabilities

One of the key lessons in Rich Dad Poor Dad is the difference between assets and liabilities. I have a background in finances so I understood this theoretically but I hadn’t applied it to my personal finances.

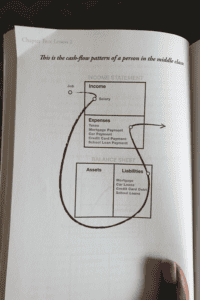

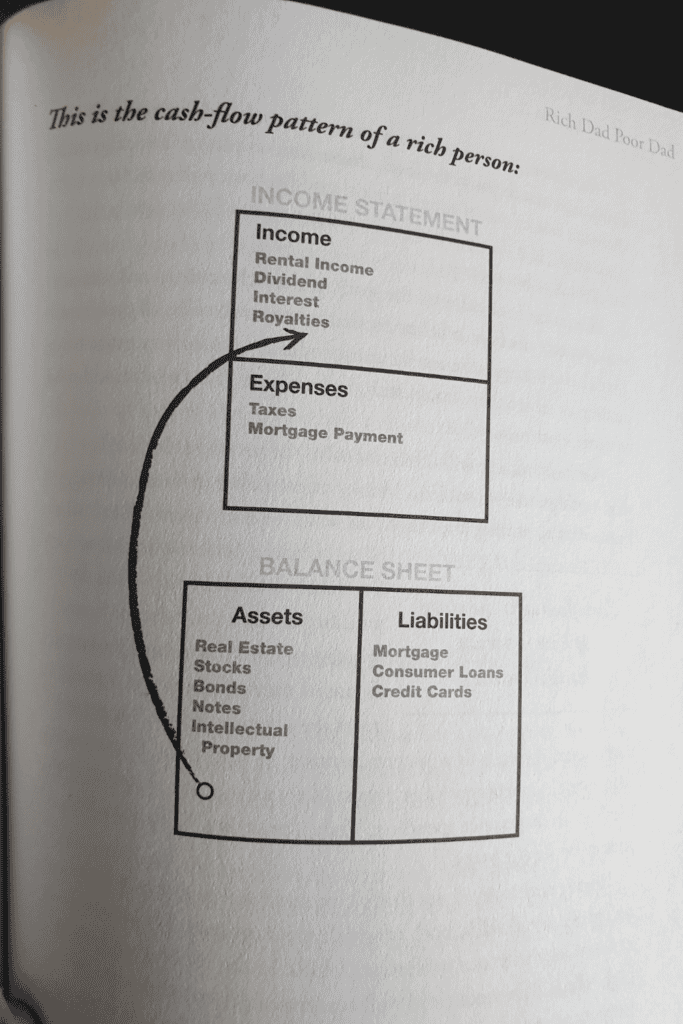

Kiyosaki explains it simply: assets put money in your pocket, while liabilities take money out. (You can see an example of this in his cash flows below).

Middle-Class Person Cash Flow

Rich Person Cash Flow

Understanding this is crucial if you want to build wealth.

To most people’s surprise, Kiyosaki doesn’t consider your primary residence an asset.

Before reading the book, I was planning to buy a home and thought of it as an asset. But his perspective made me reconsider.

In his view, if your home has a mortgage and doesn’t generate an income then it’s actually a liability because it costs you money to maintain.

This realisation completely shifted my approach. I began thinking about acquiring true income-generating assets – like rental properties before committing to buying a home.

3. Lifestyle Inflation

The book highlights how many of us are conditioned to follow the traditional path: go to school, get good grades and find a high-paying job. We continue to work for an employer and climb the corporate ladder which comes with a regular salary and some other perks.

That’s cool, I guess, but it often leads to a cycle that doesn’t support long-term happiness.

When we get promotions and raises we tend to start spending more money – this is the trap of lifestyle inflation. Instead of building wealth, we upgrade our homes, cars and luxuries which leaves little to invest in the asset column.

This is a common mistake that keeps many people living paycheck to paycheck. The reality is that this lifestyle isn’t sustainable and can lead to debt.

To break this cycle, avoid lifestyle inflation and direct any additional income to assets that generate wealth. Doing this will have a lasting impact on your finances and could eventually lead to financial independence.

4. The Power of Passive Income

Another game-changing concept in Rich Dad Poor Dad is the idea of passive income – money earned with little to no ongoing effort. Kiyosaki explains that the rich focus on building passive income streams such as real estate investments, stocks and businesses, rather than relying solely on a paycheck.

This idea really resonated with me. I used to think that earning more meant working longer hours. But Kiyosaki showed me that it’s possible to earn money without constantly trading your time for it. It’s about working smarter, not harder.

I was inspired so I began to explore different ways to generate passive income. I had already started investing in stocks, but it opened my mind to investing in real estate and creating digital products. These additional income streams have had a huge impact on my financial stability.

Related: 16 Best Passive Income Ideas

5. Overcoming The Fear of Risk

Kiyosaki’s views on risk and failure are both refreshing and empowering. He argues that many people miss out on financial opportunities because they’re too afraid to take risks.

The rich, however, are willing to take calculated risks because they understand that failure is part of the learning process.

This lesson stuck with me and is what pushed me to finally start my own business. I was scared of failing and losing money, but Kiyosaki’s words gave me the courage to take that leap of faith.

I learned to view risks not as something to avoid but as opportunities for growth. And while starting a business hasn’t been easy, the knowledge and confidence I’ve gained are priceless.

6. Work To Learn, Don’t Work For Money

I was taught to work to make money like many others, but Kiyosaki urges people not to just work for a paycheck. Instead, he encourages you to work to gain skills that will help you grow financially.

He believes in investing in knowledge and experiences that will make you more capable of building wealth in the future.

This lesson really resonated with me. I had been in the mindset of climbing the corporate ladder. However, this changed my focus to what I could learn from each role that would benefit me long-term.

Since then, I’ve looked at my career as a way to build valuable skills and knowledge, rather than just a way to pay the bills.

7. The Roles of Taxes and Corporations

This book also delves into how the wealthy use taxes and corporations to their advantage. Kiyosaki explains that the rich understand the tax system and use it to legally reduce their tax bill.

One example is how they often own corporations, which offer tax benefits that regular employees just don’t get.

For example, here in the UK, employees can pay up to 40% income tax on earnings over £37,701, but with a Limited company, you pay just 19% corporation tax on profits up to £50,000. Huge difference, right?

This lesson clicked for me instantly. Because of my experience working in finance, I understood taxes, but I had an employee mindset so I didn’t think to apply it to my personal finances. I began to see ways to use taxes to my benefit through my investments.

You can do this too by investing through tax advantage accounts like an ISA in the UK and a Roth IRA in the U.S.

Rich Dad Poor Dad: My Personal Insights and Reflections

Before reading Rich Dad Poor Dad, I thought about money the way most people do – get a good job, save what you can and spend the rest.

But this book opened my eyes to the fact that I could be doing so much more with my money. It wasn’t just about earning, but about making smarter, more strategic financial choices.

The biggest shift for me was understanding how important it is to invest in assets that work for you. This changed my mindset completely, and I began prioritising investments and building passive income streams instead of just saving for the future. It pushed me to think bigger and aim higher with my financial goals.

It also made me much more intentional about where my money was going. This gave me a real sense of control over my finances and better decision-making power.

Rich Dad Poor Dad Criticism

There’s a lot in Rich Dad Poor Dad that I agree with, especially when it comes to the importance of financial education and the need to focus on acquiring assets, not liabilities.

The book’s emphasis on passive income and investing has been instrumental in helping me build a more secure financial future.

That said, there are some points in the book that didn’t resonate with me. At times, I felt like I couldn’t entirely relate to Kiyosaki’s approach.

For example, he is biased towards investing in small-cap stocks. This may have worked well for him but I am a fan of investing in Index funds. That’s how I started investing in the stock market and I think they are a great option for beginner investors.

I also couldn’t relate to his real estate investing experiences. He talks about a real estate deal where is made $50,000 in a few hours which is impressive but felt a bit unrealistic to me.

However, it did inspire me to also invest in real estate, just in a way that made more sense for my situation.

Finally, Kiyosaki encourages everyone to become a business owner. This is a great positive message but not everyone has the risk tolerance or the desire to be an entrepreneur and that’s perfectly okay.

The key is to find what works best for you and aligns with your financial goals.

Who Should Read Rich Dad Poor Dad

If you’re new to personal finance or looking for a fresh perspective on money, Rich Dad Poor Dad is a must-read. It’s particularly useful for young women who want to take control of their finances, start investing or even consider entrepreneurship.

This book is easy to understand, even if you’re just starting out and it offers practical advice that can be applied immediately.

Final Thoughts

Rich Dad Poor Dad is more than just a book, it’s a mindset shift. It challenges the conventional wisdom about money and offers a new perspective.

There’s so much more I could say about this book, but it would turn into a very long blog post! I highly recommend reading it to fully grasp the mindset of the rich and apply its lessons to your own finances.

You might not agree with everything Kiyosaki says, but there’s plenty of valuable insight to take away. If you’re ready to rethink your approach to money and take control of your financial future, this book is a must-read.

I hope you enjoyed my Rich Dad Poor Dad book review. Have you read it yet? What are your thoughts? Let me know in the comments below.

Other Posts You May Like:

10 Life-Changing Money Mindset Books

10 Smart Income-Generating Assets You Need to Build Wealth

16 Best Passive Income Ideas (Make Money While You Sleep)

Davina Kelly

Hey! I'm Davina, the owner of Davinas Finance Corner. I'm passionate about finding ways to budget, save, earn more money and improve your life. After breaking free from payday loan debt and living paycheck to paycheck I want to share my experience to help other women improve their finances.

I think that in thes ekind of books there is something to learn…I have a lovely book The cappuccino factor by david Bach and I love read it and everytime I discover something new….is been a good reading also The no spend year: How I spent less and lived more!!!