Last Updated October 3, 2024 by Davina Kelly

Have you ever wondered why net worth skyrockets after 100k?

Ever heard the saying “Money makes money”? Or maybe, “The rich just keep getting richer”? These sayings reflect a real truth about wealth: the more money you have, the more opportunities you have to grow it.

In this post, I’ll break down why your net worth skyrockets after $100k – and, more importantly, how you can get there.

We’ll cover some practical tips to help you speed up your financial journey, whether you’re just starting out or on your way to reaching that milestone.

These are lessons I’ve learned firsthand on my own path to hitting $100k, and I hope they’ll help you reach your goals too!

This post may contain affiliate links, which means we will receive a commission if you purchase through our links, at no extra cost to you. Please read full disclosure for more information.

Why Does Net Worth Skyrocket After $100K?

A lot of people think that once you hit a certain number, like $100k, you suddenly gain access to some secret club where all the best opportunities live.

But honestly? The real reason why net worth skyrockets after $100k has more to do with two simple, but powerful concepts: capital scale and compound interest.

Capital Scale

One of the main reasons net worth increases faster after $100k is simple: the more money you have, the easier it becomes to make more money. That’s just how the numbers work.

Let’s break this down with an example.

- Suppose you invest $1,000 at a 10% return. In a year, your investment will grow to $1,100 giving you a $100 profit. Not bad, right?

- If you invest $10,000 at the same 10% return your investment will grow to $11,000 in a year, making you a $1,000 profit. Same percentage, but a lot more cash in your pocket.

- Now, if you invest $100,000 at that same 10% return, your investment grows to $110,000 in a year, and you’ve earned $10,000 in profit. See where I’m going with this?

The percentage return is the same across the board (10%). But the return you make is greater because you’re investing larger sums of money.

This is what is known as capital scale. When you invest more, you get bigger results. And once you cross that $100k mark, it feels like the growth starts happening at a faster rate.

Let’s make this even more real with an example of someone who’s just starting out and trying to build that $100k.

Let’s say Sarah is investing $500 a month in an index fund that earns 8% per year.

After five years, Sarah’s investments will grow to around $35,000. She’s only one-third of that way to $100k, but because she’s been steadily investing, the momentum starts to pick up.

By year 10, her investment will have grown to $87,000, even though she’s only contributed a total of $60,000.

That’s the power of capital scaling – it starts slow, but once you get past a certain point, it accelerates.

Compound Interest

The second major factor that helps net worth skyrocket after $100k is compound interest. Compound interest is often referred to as the “eighth wonder of the world” because of its incredible power to build wealth.

So, how does compound interest work? Simply put, it’s when you earn interest on your interest. This means your money is essentially making money for you.

In the early days, it can feel like your money isn’t doing much, but once you give it time it starts to snowball. And I mean really snowball.

Let’s look at an example to illustrate the magic of compound interest:

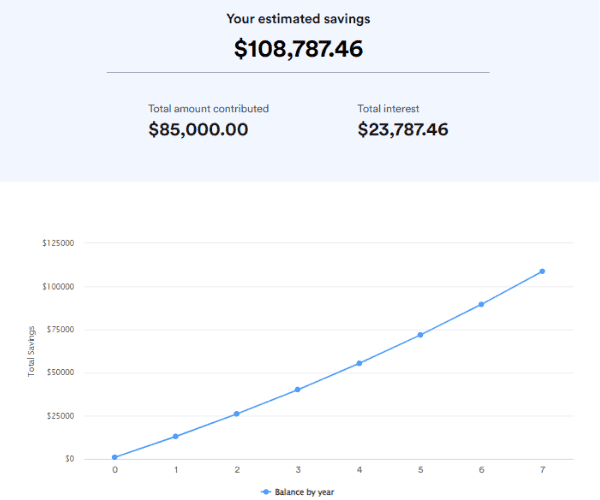

If you save $1,000 a month and earn an 8% annual return, it’ll take you around 7 years to reach $100,000. See an illustration below

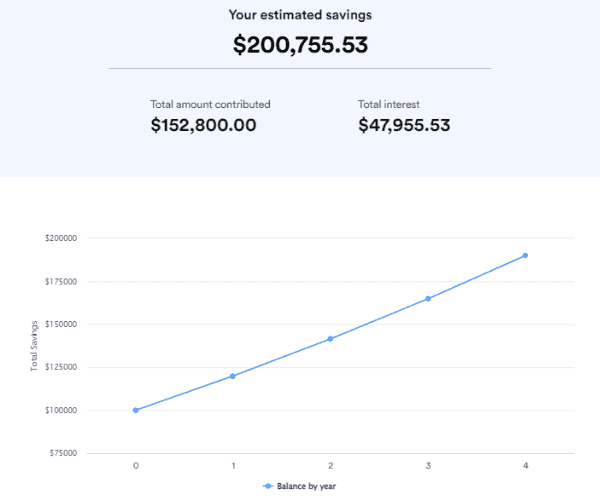

But then something interesting happens. With that $100k saved, you continue to earn an 8% return – but this time, you’re earning it on the full $100k, not just the money you’re saving every month. As a result, it’ll only take you about 4 years to save your next $100k.

Source: Bankrate Compound Calculator

From there, reaching your next $100k milestone will take just over 3 years.

The more money you have invested, the faster it compounds. By the time you hit $1 million (yes, you can totally get there), you’ll be making $100k in interest alone in just over a year. That’s compound interest working its magic.

And here’s the best part: you don’t need to understand complex investing concepts or take crazy risks to make compound interest work for you.

All you need is consistency – small, regular contributions over time will get you to that point.

The Psychological Boost of Hitting $100K

It’s not just about the numbers, though. Hitting $100k does something to your mindset too. Suddenly, building wealth feels possible and you start to think bigger.

You realise that if you can get to $100k, why not $200k? Why not $500k? That psychological shift is huge and will keep you motivated to stick to your plan, even during those moments when progress feels slow.

You’ll also start to feel more confident – that’s exactly how I felt after I saved my first $10k. I knew I could keep going. Every dollar you save after hitting that milestone feels easier because you’ve already proven to yourself that you can do it.

Getting to $100K: The Hardest Part Is Getting Started

Now, I’m gonna be completely honest with you – getting to that first $100k is tough.

You’re working hard and saving consistently, but it can feel like you’re not getting anywhere fast.

That’s because, early on you don’t have much money working for you yet. All the focus is on cutting costs, making sacrifices, and stretching every dollar.

But, those small wins really do add up. Whether you’re cutting back on takeaways or finding ways to save money on groceries – those moves matter more than you realise when you’re just starting out.

Each dollar saved and invested brings you closer to that $100k milestone, where your money really starts to work for you.

Once you hit that $100k, though? It gets so much easier. At that point, your money starts growing on its own thanks to compound interest. And trust me, you’ll start to feel the shift.

What to Focus On If You Haven’t Reached $100K (Yet!)

So, what should you do if you’re still working toward your first $100k? The key is to take advantage of time and discipline. Here are some actionable steps you can take:

1. Build an Emergency Fund First

Before you even start investing, make sure you’ve got an emergency fund in place. Think of it as your financial safety net – it’s the money you can fall back on if something unexpected comes up.

Most experts recommend having 3 – 6 month’s worth of living expenses saved in an accessible, high-yield savings account. If you can save this amount great, if not you can start with $1,000 and build from there.

This isn’t just about peace of mind (though that’s a big plus), it’s about making sure you don’t need to tap into your investments in an emergency. You want your investments to grow undisturbed by short-term needs.

2. Tackle Debt Strategically

Debt is one of the biggest hurdles to building wealth, especially high-interest debt like credit cards or personal loans. But here’s the good news: you can still build wealth while tackling debt, as long as you’re strategic about it.

If you’ve got high-interest debt (we’re talking 8% or more), focus on paying that down aggressively first. The interest you’re paying is likely a lot more than what you’d earn from investing. Once your high-interest debt is under control, then you can focus more on investing and letting your money work for you.

For lower-interest debt (like student loans or a mortgage), consider a hybrid approach – pay down the debt while also investing. This way, you’re building wealth and improving your net worth at the same time.

3. Extend Your Investment Timeline

One of the most powerful factors in growing your wealth is time. The longer you can leave your money invested, the more opportunity you give it to grow.

For example, let’s say you earn $60,000 per year and you invest 20% of your income (or $12,000 a year). At an average 8% return, it will take you about 23 years to reach a net worth of $730,000.

But if you keep investing for just four more years – extending your investment timeline to 27 years – you’ll surpass the $1 million mark.

The point I am making here is that the real gains come at the end of your investment journey, not at the beginning. So, even if you’re just starting, the earlier you begin, the more significant your returns will be down the line.

4. Increase the Amount You Invest

Time is a huge factor in why your net worth skyrockets after $100k. However, the amount you invest plays an equally important role in speeding up your wealth-building journey.

And here’s the good news: you don’t need a $100,000 lump sum to get started. Instead, focus on increasing the amount you can contribute each month.

A lot of people get caught up in trying to optimise their investments for slightly higher returns, like getting an extra 1% or 2% a year. Don’t get me wrong, higher returns are great, but the real game-changer is how much you’re investing in the first place.

Many people think “Well, I’m only earning X amount, so I can only afford to invest a small amount”. And that might be true depending on your circumstances. But here’s the key: as your income grows, your investments should grow too.

When I first started my investing journey, I could only afford to put in $250 a month. But as my income increased I made sure to increase my investment contributions – and it made a huge difference.

Let’s compare two scenarios:

If you invest $200 a month for 30 years at a 10% return, you’ll end up with just under $400,000.

Now, if you manage to increase your returns by 2%, raising your average annual returns to 12%, your total after 30 years will just be under $600,000.

That’s a huge difference. But what if, instead of focusing on trying to optimise your returns, you doubled the amount you invested each month?

If you invested $400 a month for 30 years at the same 10% return, you’d end up with just under $800,000.

Essentially, increasing the amount you invest has a more significant impact on your total wealth than trying to optimise for slightly higher returns.

5. Focus on Earning More

If you want to increase how much you’re investing each month, the most effective strategy is to focus on increasing your income.

Here are some of the ways you could do this:

Negotiate your salary

If you’re employed, negotiating a raise is one of the quickest ways to increase your income. Even a small percentage increase in your salary can have a huge impact when invested over time.

Before asking for a raise, do some research to understand your market value, highlight your achievements, and practice making your case confidently.

Start a side hustle

Starting a side hustle can be a great way to bring in extra cash. Whether it’s taking on freelancing jobs, selling digital products or offering services you’re skilled at. The additional income can go directly to your investments and help you grow your wealth even faster.

Plus, a side hustle can grow over time and give you more financial flexibility and independence.

Related:

23 Best Side Hustles for Women

Upskill or switch jobs

One of the smartest ways to increase your earning potential is by gaining new skills or certifications to make you more valuable in the job market

If your current role isn’t offering room for growth, it might be time to explore high-paying jobs or even switch industries altogether.

If you’re ready to learn new skills and boost your career, I highly recommend Skillshare. It’s an amazing online learning platform offering thousands of classes to help you grow, whether you’re getting into digital marketing, AI or data analytics.

You can try it out FREE for 30 days here Start learning today and unlock your earning potential.

Explore passive income streams

Beyond active forms of income from your job or side hustle, look for ways to earn passive income. This can include things like rental properties, dividend-paying stocks or even creating content that generates royalties.

Passive income can grow over time and become a reliable income stream to boost your investments. It’s also a great way to make money alongside your full-time job.

The point is, focusing on earning more can have a massive impact on your ability to build wealth. Once you have more money, coming in, the stock market becomes a way to multiply your wealth, not just a place to optimise returns.

Remember, it’s not just about working harder, but working smarter and finding ways to grow your income that fit your lifestyle and long-term goals.

And here’s the best part: As you earn more, the snowball effect of your investments will take over, getting you closer to your financial milestones faster.

6. Automate Your Investments

One of the simplest ways to build wealth is to make investing automatic. If you have to manually decide to transfer money into your investment accounts every month – it’s going to feel way harder than it needs to be.

Automating your investments takes the decision-making (and the temptations to spend) out of the equation.

Set up automatic transfers to your investment accounts as soon as you get paid, so it’s out of sight, out of mind. You’ll be surprised how quickly those little contributions start to stack up when you’re not actively thinking about them.

7. Maximise Tax-Advantaged Accounts

If you’re not already contributing to tax-advantaged accounts you could be leaving money on the table. This includes a 401(k), Roth IRA or an ISA if you’re in the UK.

Not only do these accounts give you potential tax breaks, but some employers even offer matching contributions.

Max out these accounts as much as you can. Your future self will thank you.

Final Thoughts about Why Net Worth Skyrockets After $100k

Building wealth is a marathon, not a sprint. It’s the small wins – cutting expenses, saving regularly, increasing your income – that ultimately get you to that $100k milestone.

And once you get there, the journey becomes a lot easier, thanks to the combined power of capital scale and compound interest.

Remember, the most important thing is to start. Whether you’re saving $100 or $1,000 a month, each dollar is a step closer to your financial goals.

Focus on investing regularly, increasing the amount you invest over time and taking advantage of the power of compound interest and capital scale.

Once you hit $100k, you’ll see just how fast your net worth can skyrocket!

This post was all about why net worth skyrockets after $100k.

Other Posts You May Like:

The Ultimate Beginners Guide To Investing

The Best Order To Invest Your Money

13 Best Money Saving Strategies

Davina Kelly

Hey! I'm Davina, the owner of Davinas Finance Corner. I'm passionate about finding ways to budget, save, earn more money and improve your life. After breaking free from payday loan debt and living paycheck to paycheck I want to share my experience to help other women improve their finances.