Last Updated May 29, 2025 by Davina Kelly

Financial freedom often seems like a distant dream, something only the lucky few get to experience.

But the truth is, it’s not an exclusive privilege reserved for the wealthy or financially savvy.

Achieving financial freedom doesn’t require a complicated formula or a secret trick. Instead, it comes down to planning, budgeting and making smart financial decisions.

In this post, I’ll walk you through a simple six-step plan to master your finances with confidence and less stress.

By following these steps, you’ll gain financial stability, build wealth and ultimately create a life where money is a tool, not a source of worry.

What Does Financial Freedom Mean to You?

Before we get into these steps, take a moment to think about what financial freedom looks like for you.

For some, it means:

- Being able to quit a job you hate

- Eating at fancy restaurants without guilt

- Owning a home without struggle

- Travelling the world

- Working because you want to, not because you have to

- Trying new experiences without second-guessing the expense

At its core, financial freedom isn’t just about having a certain amount of money, it’s about control, confidence and flexibility.

It’s about knowing you can spend on what you love today without jeopardising your future goals.

Now, let’s get into an easy plan to get you there.

Key Takeaways:

- Track your spending

- Create a budget and stick to it.

- Get rid of high-interest debt.

- Build a strong emergency fund.

- Start investing as soon as possible.

- Educate yourself on personal finance.

- Find ways to increase and diversify your income

- Review and adjust your finances

5 Simple Steps To Financial Freedom:

Step 1: Track Your Spending & Financial Health

The first step in gaining control of your finances is knowing exactly where your money is going.

Many people set vague financial goals like “I want to save more this year” or “I’ll try to spend less this month.”

But when asked how much they actually spent last month, most have no clue.

If you don’t know where your money is going, how can you expect to manage it better?

How To Track Your Finances

Categorise your expenses into three sections:

Essential expenses

- Rent/mortgage

- Utilities, transportation

- Groceries

- Minimum debt payments

These are your non-negotiable costs. Aim to keep these under 50-60% of your take-home pay.

Your future

- Savings

- Retirement funds

- Investments

Ideally, at least 20% of your income should go here.

Non-essential expenses

- Eating out

- shopping

- entertainment and travel

These are the things that bring you joy, but need to be controlled.

Here’s how to actually do it:

Review your last 1–3 months of bank statements.

Go through every transaction and assign it to one of the three categories above. Use a notebook, spreadsheet, or an app like Mint or YNAB.

Add it up

Total how much you’ve spent in each category. Are you overspending in any area? Are you spending on unnecessary expenses?

Spot the leaks

Look for recurring charges or patterns you’ve overlooked — subscriptions you forgot to cancel, random takeout orders, or online impulse buys.

Track your spending going forward

Whether you use a budgeting app or a simple spreadsheet, commit to checking in weekly.

Even just 5–10 minutes on a Sunday can help you stay on track and make better decisions.

Why this matters:

Once you know where your money is going, you can take back control.

Instead of wondering where your paycheck disappeared to, you’ll be able to confidently tell your money what to do, and make steady progress toward financial freedom.

Step 2: Budget Wisely – Give Every Dollar a Job

Budgeting is the foundation of financial success.

Without a plan for your money, it’s easy to overspend and find yourself struggling to save or invest.

A great way to structure your budget is by following the 60-30-10 rule:

- 60% towards your future – Savings, investing or paying off debt.

- 30% for essential expenses – Rent/mortgage, groceries, utilities, transportation and other necessities.

- 10% towards your wants – This is your fun money, think spa days, shopping, the movies, etc.

You can read here to learn how to create this budget step by step.

This method ensures that you’re covering your expenses while also saving and investing for the future.

You don’t have to stick to these exact percentages, adjust them based on your financial situation, but make sure you allocate money for all three areas.

Grab my FREE budget template below and put your budget together.

Step 3: Save & Repay Debt

Saving money and paying off debt go hand in hand.

The goal is to build a safety net while also eliminating costly financial burdens.

Start with an Emergency Fund

Did you know that, according to Bankrate, 59% of Americans are uncomfortable with their level of emergency savings?

And 34% are living paycheck to paycheck?

So, if you can save just one month’s worth of living expenses, you’re already ahead of most people.

This fund isn’t for long-term investments, it’s a psychological safety net.

Knowing you have some savings reduces financial stress when unexpected expenses arise.

Pay Off High-Interest Debt

Once you’ve saved a one-month emergency fund focus, on paying off high-interest debt (like credit cards) before building a larger savings cushion.

You’re probably wondering why, so let’s break it down:

Let’s say you have $5,000 in savings earning 5% interest, this makes you $250 per year

You also have $5,000 in credit card debt at 22% interest, which costs you $1,100 per year

By keeping both, you’re losing $850 per year!

Essentially, paying off high-interest debt first saves you more in the long run.

Once that’s done, you can build your emergency fund to 3 – 6 months’ worth of expenses.

Here is the order of action:

Save one month’s worth of expenses

Pay off high-interest debt (credit cards, payday loans).

Build a full emergency fund (3 – 6 months of expenses).

Once your savings and debt are under control, it’s time to build wealth!

Step 4: Invest for Your Future

Saving money is great, but investing is how you actually build long-term wealth.

Inflation eats away at the value of your cash, so your money needs to grow over time.

At least 10% of your income should be invested every month.

Here are some places you can invest your money:

- Stock market – Invest in index funds, ETFs or individual stocks

- Real Estate – If you have the resources, real estate can be a great way to build wealth.

- Retirement Accounts – If your employer offers a 401 (k) with a matching contribution, take advantage of it. If not, consider an IRA.

- Invest in yourself – Learning new skills, taking courses or advancing your career can increase your earning potential

When it comes to investing, the best time to start is now. However, the earlier you start, the better.

Let’s compare two scenarios to understand why:

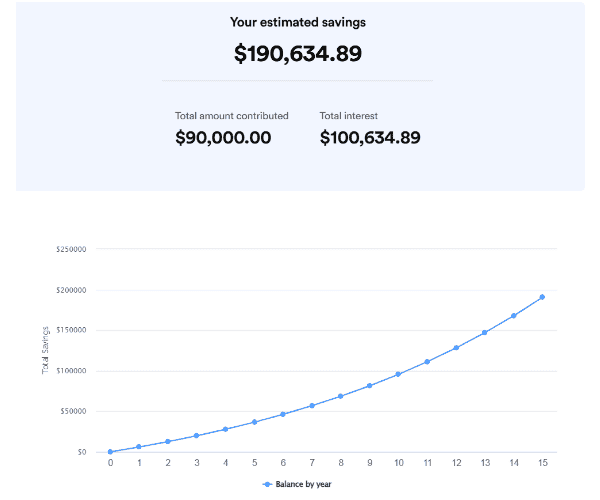

Scenario A: Start investing at 35 years old, putting away $500 per month for 15 years.

With a 10% return, by 50, you’d have $190,635, with $100,635 of that being interest earnings!

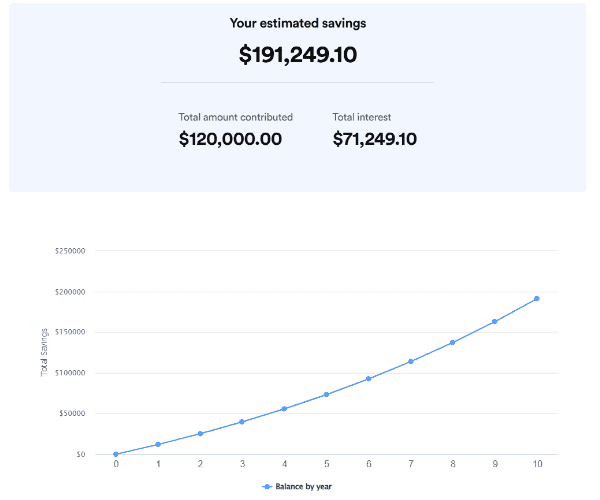

Scenario B: Start investing at 40 years old, but double your contributions to $1,000 per month for 10 years.

By 50, you’d still reach $191,249, but you had to contribute twice as much out of pocket.

Source: Bankrate Compound Interest Calculator

Source: Bankrate Compound Interest Calculator

The point I’m making is, it’s best to start as early as possible to take full advantage of compounding.

Step 5: Enhance Your Financial Literacy (Knowledge Is Power)

One of the biggest mistakes people make is not educating themselves about money. The more you know, the better financial decisions you’ll make.

Here are some ways to improve your financial literacy:

- Read books about personal finance and investing

- Follow reputable finance YouTube channels and blogs like this one

- Listen to finance podcasts

- Attend workshops or courses on money management

By continuously learning, you’ll develop the confidence and skills to make smarter financial choices.

Step 6: Diversify Your Income Streams

Relying on a single paycheck can be risky.

If something happens to your job, your entire income stream disappears.

To achieve financial freedom, it’s crucial to diversify your income.

Here are some ideas for income streams:

- Side Hustles – Freelancing, consulting or selling products online.

- Passive income – Create digital products, start a blog or invest in dividend stocks

- Rental Income – If you have extra space, consider renting it out.

- Invest in Yourself – Gain new skills that increase your earning potential

The more income streams you have, the more financially secure you’ll be.

Step 7: Manage & Adjust Your Finances

Managing your money isn’t a one-time thing.

Just like you review your health, career or relationships, you should check in on your finances regularly.

As your income grows, it’s natural to start spending more money.

But if your spending increases at the same pace (or faster!) than your income, you’ll never break free from the paycheck-to-paycheck cycle.

Beware of Lifestyle Creep

Benjamin Franklin once said: “Beware of little expenses. A small leak will sink a great ship”.

A great way to stay on top of this is to include quarterly or annual financial check-ups.

Every 3 -4 months, review your finances and make adjustments:

- Increase your savings and investments.

- Adjust your budget based on new goals.

- Evaluate your risk appetite as you approach retirement.

Final Thoughts

Financial freedom doesn’t happen overnight. By taking these steps, you’ll be well on your way to a secure and wealthy future.

Just to recap, here are the steps you need to take to reach financial freedom:

- Track your spending

- Create a budget and stick to it.

- Get rid of high-interest debt.

- Build a strong emergency fund.

- Start investing as soon as possible.

- Educate yourself on personal finance.

- Find ways to increase and diversify your income

- Review and adjust your finances

Other Posts You May Like:

10 Must Read Money Mindset Books

19 Personal Finance Tips Everyone Should Know

10 Best Financial Goal Examples To Fast Track Wealth

Davina Kelly

Hey! I'm Davina, the owner of Davinas Finance Corner. I'm passionate about finding ways to budget, save, earn more money and improve your life. After breaking free from payday loan debt and living paycheck to paycheck I want to share my experience to help other women improve their finances.