Last Updated February 18, 2024 by Davina Kelly

Are you trying to figure out how to invest in index funds uk? This was me a few years ago so I totally feel you.

If you are like me you have spent hours researching how to get started, but most of the information is from a U.S. perspective.

As an investor, I will share everything I have learned on my journey to get started investing in index funds in the UK.

I will cover everything from the best platforms to use to what you need to look out for.

I will keep everything simple and easy to understand as investing doesn’t need to be complicated.

This post is all about how to invest in index funds UK.

How To Invest In Index Funds UK – Step By Step:

Decide Which Index You Want To Invest In

The first thing you need to do is decide which type of index you want to invest in. There are many options. You could choose to invest in an index that tracks emerging markets or companies in specific parts of the world.

I would recommend spending time researching this as you want to ensure you are choosing the best index funds for your goals.

If you are brand new to investing, the S&P 500 or the FTSE 100 are good places to start.

The S&P 500 includes the biggest companies in the US such as Apple, Microsoft, and Amazon. The FTSE 100 includes the biggest companies in the UK like HSBC, Shell, and Unilever.

These options will give you a piece of all of the action in the biggest parts of the world.

Things To Look Out For

When you are deciding which index fund to invest in you need to look out for a few things.

- Price & performance – This will show you how the fund has performed over time

- Portfolio data – This will show you information such as the number of stocks in the fund, market capitalization, etc. It will show you this information compared to the index benchmark it is tracking

- Distributions – This shows you how often your dividend is paid and the percentage it offers

- Costs & minimums – This shows the fees charged for investing in the fund, also known as the expense ratio. It will also show you the minimum amount you need to invest if there is one.

Choose an Investment Platform

The best platforms to invest in index funds in the UK are as follows.

- Vanguard – This platform has over 70 index funds to choose from with very low fees

- Hargreaves Lansdown – This platform has over 3,000 funds to choose from

- AJ Bell – This platform has 2,000 options to choose from

Once you have chosen your platform you will need to open an account and input all of your information such as full name, address, ID, bank details, etc.

Choose a Tax-efficient Account To Invest With

Once you have decided on the type of index fund you want to invest in and have chosen the platform you want to use, you need to decide which type of account you want to invest with.

Each platform will offer different types of accounts such as

- Stocks and Shares account

- Junior account

- General account

- Pension account

In the UK we have ISA accounts (Individual savings accounts) which allow us to save and invest tax-free within a £20,000 allowance. I would recommend investing through an ISA account as this is a tax-efficient way to invest.

For example, you could open a stocks and shares ISA or a Lifetime ISA on your chosen platform. The benefit of investing with these accounts is that you won’t have to pay tax on your profits as long as it is within the £20,000 threshold. Read here to learn more about ISA accounts.

Decide How Much You Want To Invest

The amount of money you invest is entirely dependent on how much you can afford. You don’t need to invest tons of money to be a successful investor, you can invest small amounts regularly and still benefit from great returns.

You can decide to invest a fixed amount each month, for example, you could invest £200 a month or you could invest a percentage of your income each month. Do what works best for you and your financial situation.

Pick a Strategy

To get the most out of your investments I would recommend investing the same amount of money consistently. This strategy is known as dollar cost averaging, in our case pound cost averaging. Investing this way will mean that whether the share price goes up or down you will benefit from the average price. This is a simple way to invest and the key to building wealth.

To make this process simple I would have your payments set up on autopilot. Once you have decided how much you can afford to invest each month, you can set up a standing order.

The platform will then take this amount from your account and invest it into your chosen fund each month for you. It doesn’t get any more simple than that, this removes all of the guesswork for you.

These steps will help you to get started with investing in index funds. Below I will share more information I think you need to know.

How To Invest In Index Funds UK – Key Information:

What Are Index Funds?

An index fund is a fund that tracks the overall performance of an entire market index. A market index will track the performance of a particular industry or group of stocks.

The most popular index is the Standard & Poor’s 500 (S&P 500). This is an index that tracks the stock performance of the 500 largest companies in the U.S. In this example, the market index is the 500 largest companies in the U.S.

In the UK we have the FTSE 100, this index tracks the 100 largest companies listed on the London Stock Exchange with the highest market capitalisation. The market index in this example is the 100 companies with the largest market capitalisation.

The S&P 500 and the FTSE 100 are indexes, this means they measure the price performance of these groups of shares so you can’t buy them directly. This is where index funds come in.

How Do Index Funds Work?

The way index funds work is the fund will buy shares in all of the companies listed in the index it is tracking. If you choose to track the FTSE 100 the fund will buy shares in every company in the FTSE 100.

The index fund aims to track the market, not to beat it. It will do this if the index is going up or down so you could get back less than you invested.

Benefits Of Investing In Index Funds

Investing in index funds is a simple approach to investing. Instead of choosing individual stocks that you think will do well or relying on analysts or fund managers to do it for you, you can just buy an index fund.

They are an easy low-cost way to invest and it is a great way to get started if you are a beginner. These types of funds are diversified as they can hold hundreds of shares, this will give you exposure to an entire market and different parts of the world. Having your investments spread out this way will reduce your risk.

If you had £1,000 to invest and chose to invest in an individual stock and the stock value plummeted all of your capital will be at risk. But with index funds, your risk is minimal because if one of the stocks in your fund isn’t performing well the others will make up for it and balance it out.

These funds come with low fees because they are not actively managed. The fund is tracking an index so it is essentially managed by a computer. No one is choosing the stocks for you, the fund is simply tracking the index.

What this also means is if a company within the index is no longer performing well, it will be replaced by another company. This makes index funds a passive investment strategy.

The simple approach, diversification, low fees, and passive strategy make investing in index funds the best option for beginners. You can simply invest in your chosen index fund consistently and benefit from healthy long-term returns.

This simple style of investing was created by Jack Bogle the founder of the platform Vanguard. His quote was ‘’Don’t look for the needle in the haystack. Just buy the haystack.’’

What Are ETFs?

Exchange Traded Funds known as ETFs are a type of index fund. The terms index funds and ETFs are often used interchangeably and I know this can be confusing.

An ETF is a basket of securities containing businesses that operate the same or sell similar products. The difference between an index fund and an ETF is that an ETF can be bought and sold on the stock market throughout the day just like stocks.

Buying shares in this way means that you have real-time pricing, whereas index funds can only be bought or sold at the end of the trading day. This means that you won’t know the price until after you have placed your trade. This isn’t necessarily a bad thing, it is just a distinction to be aware of.

Information About Investment Platforms

The investment platform will allow you to actually be able to buy funds on the stock market. The platform you choose is very important for a few reasons, see them listed below.

Options:

Each platform carries different options so you want to ensure the platform you choose has the type of funds you want to invest in.

It sounds obvious but I need to point it out.

Fees:

There are many fees associated with investing. We want to keep these fees low as they can start to eat into your profits and you don’t want that.

Some of the fees you need to look out for are as follows.

Ongoing charge (sometimes referred to as OCF):

Even though the fund isn’t actively managed the platform will charge a management fee.

This covers the day-to-day management costs and admin expenses.

I would recommend going for index funds with fees of 0.07% or lower.

Fund transaction costs:

When you invest in a fund the platform has to buy and sell shares or funds which will incur fees for dealing and taxes. These are the fund transaction costs.

One-off costs:

You will incur one-off costs when you purchase an ETF, this is known as ‘’the spread’’.

As ETFs are traded like shares there is the price that you can buy the ETF for (the offer price) and the price that you can sell the ETF for (the bid). The spread is essentially the difference between the two prices.

Account fees:

The account fee is for running the platform, customer service, and keeping your investments safe which is super important.

Read here to learn about Vanguard’s fees, this article will show you an example in more detail.

Other things to look out for are usability. You want to ensure the platform is easy to use, you don’t want to feel overwhelmed and confused when you log in to view your portfolio.

You also want to ensure that there is customer support available. I think this is super important when you are first getting started. This will give you peace of mind in case you have any questions or require more information.

The platform you choose should be regulated by the FCA (Financial Conduct Authority). This will ensure that your money is protected. You can usually see this information in the footer of the investing platform’s website.

Income or Accumulation

When you invest in an index fund there are two different types of share classes, income and accumulation.

Income:

This is where the dividend is distributed to you as a payment. For example, if the FTSE 100 paid 4% dividends quarterly you would receive this payment in your portfolio account at the end of the quarter.

Accumulation:

Accumulation is when the dividends are reinvested back into the fund automatically. This increases your capital and allows your investment to grow even more over time.

The fund you choose will already have a determined share class so this is something you want to factor in when deciding which index fund to invest in.

Other Ways Index Funds Make Money

Interest:

Interest is the amount the fund grows by year on year, this is also called your return. For example, if you invested £1,000 in the FTSE 100 in year 1 and it returned 10% your investment would be worth £1,100 in year 2. In year 2 you would earn 10% on £1,100 making the value £1,210.

This is the power of compound interest. Essentially your interest is earning you interest, you make an initial investment and it continues to compound and grow over time. Albert Einstein called this the eighth wonder of the world and It is easy to see why.

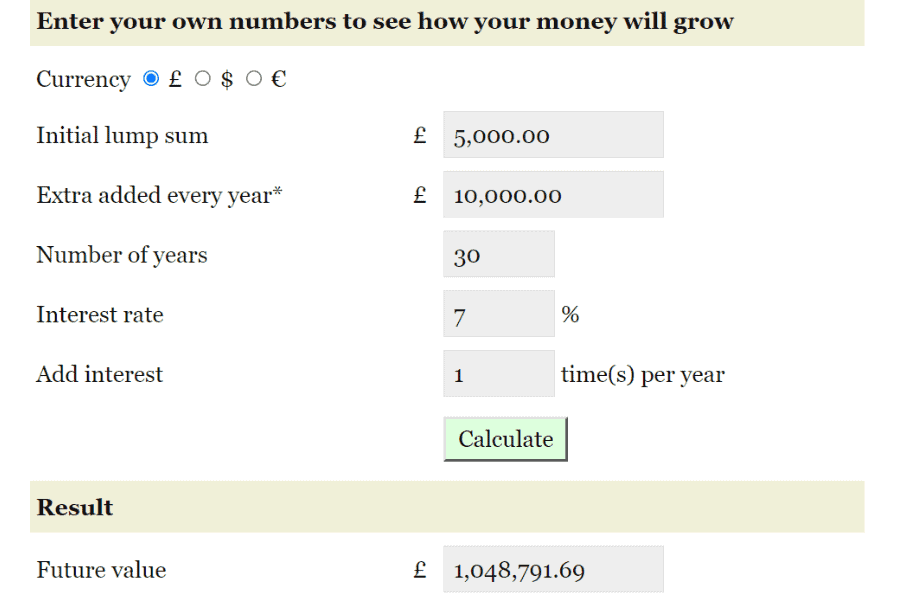

Below is an example of how your investment can grow over time if you use the pound cost-averaging strategy.

Source: Monevator

This strategy is powerful because all you need to do is invest consistently over time and watch your money grow. This is how you make money in your sleep.

Dividends:

Dividends are a portion of the profits paid to the shareholders. The dividend amount and payment frequency will differ with each investment. Some funds will pay them quarterly, some will pay bi-annually.

Beware of Tax Implications

Something that a lot of people often overlook when investing is tax. You have to pay capital gains tax on the profits you make from your investments. This is because it is essentially income and we have to pay tax on income.

The tax becomes due when you realise the gains. For example, if you invested £5,000 in index funds and the value increased to £10,000 when you withdraw the money or (realise the gains) you will need to pay capital gains tax on your £5,000 profits.

As I mentioned before, if you invest through a stocks and shares ISA and you are within your £20,000 allowance you won’t need to pay capital gains tax. So this is a smart way to invest.

Mindset When Investing

When you begin investing it is important to have the right mindset. Having the right mindset can help you stay calm when there are drops in the stock market, this is important because it can cause you to panic and do something you regret.

Determine Why You Are Investing:

A good way to do this is to be clear on why you are investing, knowing your why will allow you to adopt the right mindset. For example, are you investing for retirement? If so you will have a long-term approach. This will mean your main focus is investing consistently and benefitting from long-term gains.

In this example, time is your greatest asset so the short-term fluctuations won’t affect you as you will know that over time the share price will recover and continue to grow.

If you are investing because you want to buy your dream car in the medium term (the next 2 – 4 years) the fluctuations in the stock market would affect you.

If your goal is to make money for the medium term and realise your gains I would recommend putting your money into a high-yield savings account instead. This way your money can still grow from the interest and it is easier to access.

My approach to investing is simple, this is why I love index funds so much. I choose my funds, have pound cost averaging set up on auto-pilot, and my money grows.

Review Your Portfolio

Checking your investment portfolio is important as you want to see how your investments are performing. This is also the best way to learn more about the stock market and how it works.

But you don’t need to check it all of the time. If you log into your portfolio every day and can see that the share price is falling and your investments are down, it can make you feel overwhelmed and you may panic. The only time the share price actually matters is when you are going to sell your investments. I would recommend checking your portfolio every quarter in the beginning.

Educate Yourself About Money

Whether we like it or not money makes the world go around, so it is important to understand how it works.

We all know how money works on a basic level, but I think it is important to learn how it works on a deeper level.

Knowing things like how the economy works, what causes inflation, and how interest rate increases affect us are all important and impact our everyday lives.

An easy way to learn how money works is through reading. Some good books are Rich Dad Poor Dad and The Psychology Of Money.

Rich Dad Poor Dad covers how the rich view money and use it as a tool to make more money compared to poor people who spend money on liabilities and work to pay them off. This book really opened my eyes and changed my money mindset.

The Psychology of Money talks about people’s behaviour towards money through stories, this book is very insightful.

You could also watch documentaries or series, I am currently watching ‘How To Get Rich’ on Netflix. This series is focused on money management, but it is interesting and has a lot of good takeaways.

YouTube is also a good place to learn as there are real people who are sharing their knowledge and journey with money. A good channel to watch is Jennifer Kempson, she is from the UK and shares tips on how to manage your money and invest.

Frequently Asked Questions

How Do Beginners Buy Index Funds?

If you are a beginner I will summarise the steps you can follow to get started. I would recommend spending a little more time researching the different index fund options to ensure you choose the correct fund for you.

- Decide which index fund you want to invest in

- Choose an investment platform

- Choose a Tax-efficient Account To Invest With

- Decide how much money you want to invest

- Pick a strategy

I also have a post on investing for beginners, this is helpful as it covers all of the information you will need to get started in a simple way. Read it here.

How Do I Buy The S&P 500 Index Fund UK?

To buy index funds in the UK you need to choose the platform you want to invest with.

The best platforms to invest in index funds in the UK are as follows:

- Vanguard – This platform has over 70 index funds to choose from with very low fees

- Hargreaves Lansdown – This platform has over 3,000 funds to choose from

- AJ Bell – This platform has 2,000 options to choose from

Once you have chosen your platform you need to add some money to your investment account. Once you have done this search for the S&P 500. For example, on the Vanguard platform, the S&P 500 is called the S&P 500 UCITS ETF (VUSA).

Once you have found this click on Invest Now and follow the instructions.

Final Thoughts

I know that investing can seem overwhelming when you are first getting started. The jargon can make it seem like a foreign language and the fear of losing your money can put you off completely.

But it can be simplified, this is why I love investing in index funds, they are a simple way to invest and build wealth in the UK.

Index funds are a great investing option for beginners to advanced investors.

They come with many benefits such as your portfolio being diversified which will minimise risk, they have low fees, and they are a passive investment strategy.

If you follow the steps above and stay focused on your goals you will grow your portfolio in no time.

Have you found these steps and the information I have provided helpful? Which index funds have you chosen to invest in?

This post is all about how to invest in index funds UK.

Davina Kelly

Hey! I'm Davina, the owner of Davinas Finance Corner. I'm passionate about finding ways to budget, save, earn more money and improve your life. After breaking free from payday loan debt and living paycheck to paycheck I want to share my experience to help other women improve their finances.